Envoy: Russia, Qatar Aim to Ditch Dollar in Bilateral Trade

By Staff, Agencies

The Russian ambassador to Qatar says the two countries are seeking to use national currencies in their bilateral trade amid an accelerating wave of de-dollarization across the world.

In an interview with Russia’s RIA Novosti news agency on Monday, Dmitry Dogadkin said that works are underway to diversify away from the US greenback.

“Russia has proposed to diversify mutual trade [with Qatar] and switch to the use of national currencies. Work in this direction is being carried out between our relevant departments,” he said.

For decades, the US dollar has been the dominant currency in the global financial system.

In recent years, however, a de-dollarization trend has gained momentum as countries try to reduce their exposure to the risks and fluctuations associated with the American currency.

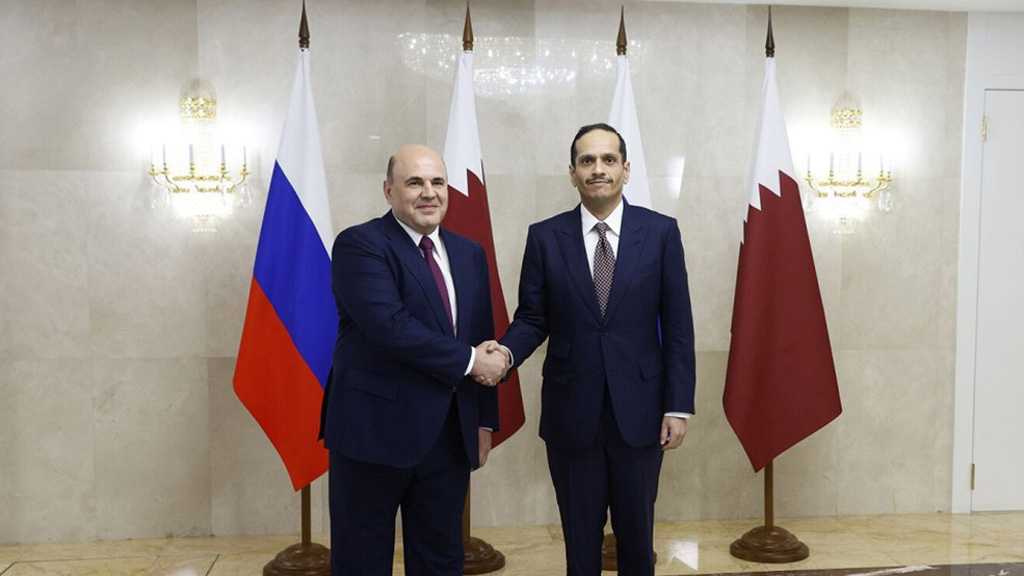

In June, during a meeting, Russian Prime Minister Mikhail Mishustin and Qatari Prime Minister and Foreign Minister Sheikh Mohammed Bin Abdulrahman Al Thani discussed using the ruble and the riyal in payments.

The Russian premier said at the time that the switch to local currencies is meant to “stimulate the launch of new joint projects more actively.”

“Amid a difficult global economic situation, mutual trade in January-April reached over 1.5 billion rubles or almost 70 million Qatari riyals,” he added.

“Russia and Qatar have established a long-term strategic partnership in the energy sector. Qatar Investment Authority is the largest stakeholder of [the Russian energy company] Rosneft.”

In mid-July, India and Indonesia agreed to use their local currencies in bilateral trade.

The announcement came some days after India’s Prime Minister Narendra Modi’s visit to UAE, where the two countries signed a memorandum of understanding to establish “a framework for the use of local currencies for transactions between India and the UAE,” according to the Indian central bank.

In February, the Central Bank of Iraq, a major oil supplier, announced that it will allow trade with China to be settled in the Yuan for the first time.

Comments

- Related News